Aeroflex Industries

2025-01-26

-

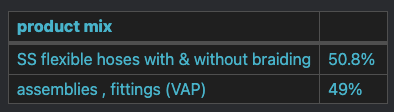

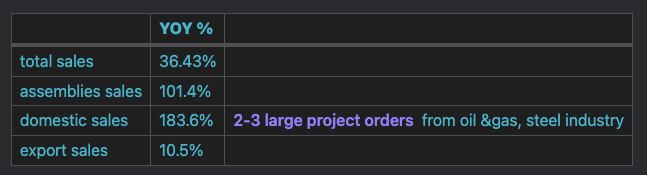

product mix change (increase in value added products)

- focus is on assemblies and fittings

- assembly business contribution increased to 49% of sales

-

management changes

- Kiran kagalkar as COO

- Brings 37 years of experience, including 25 years at Parker Hannifin india

-

inorganic acquisition

- Hyd-Air Engineering Pvt Ltd

- recieved order from railway coach factory

- Entry into new industries - Railways, Shipbuilding, Heavy industries

- Remaining capex: INR 11.5 crores out of INR 18 crores planned

- guidance of 15-20% net profit margin once the expansion is complete

- Hyd-Air Engineering Pvt Ltd

-

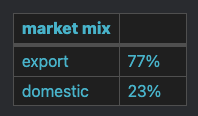

US remains largest export market

-

margins better in export vs domestic

-

plans of QIP in the future

-

Focus on achieving 24-25% EBITDA margins by FY27

end user industries :

- traditional industries :

- oil & gas, chemical, petrochem, steel(24-25%)

- new age industries :

- firefighting equipments, solar

capex mostly funded by internal accruals

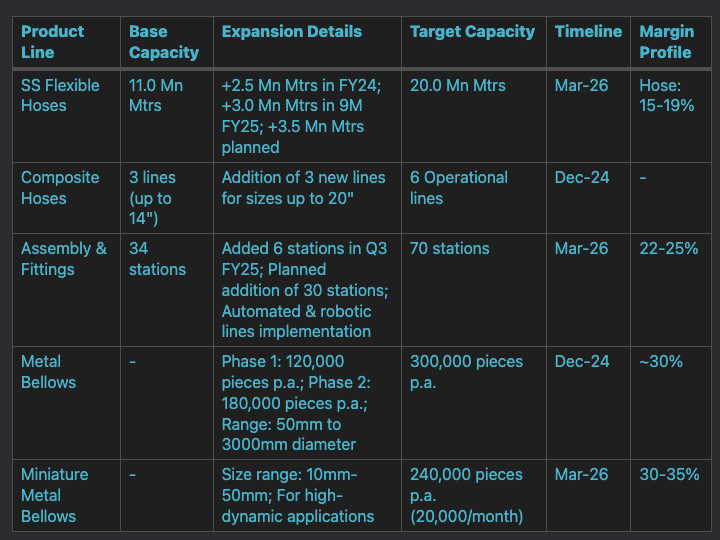

if we talk about 20 million meters and if we talk about, I'd say -- so currently, our aim is that over the next couple of years to have a higher portion of the business coming from assembly. So, say, for example, if I assume that if I get 70% of my sales from assembly over the next couple of years -- sorry, after 2 years, so then we are looking at a revenue potential of anywhere just from INR650 crores to about INR675 crores at peak utilization.